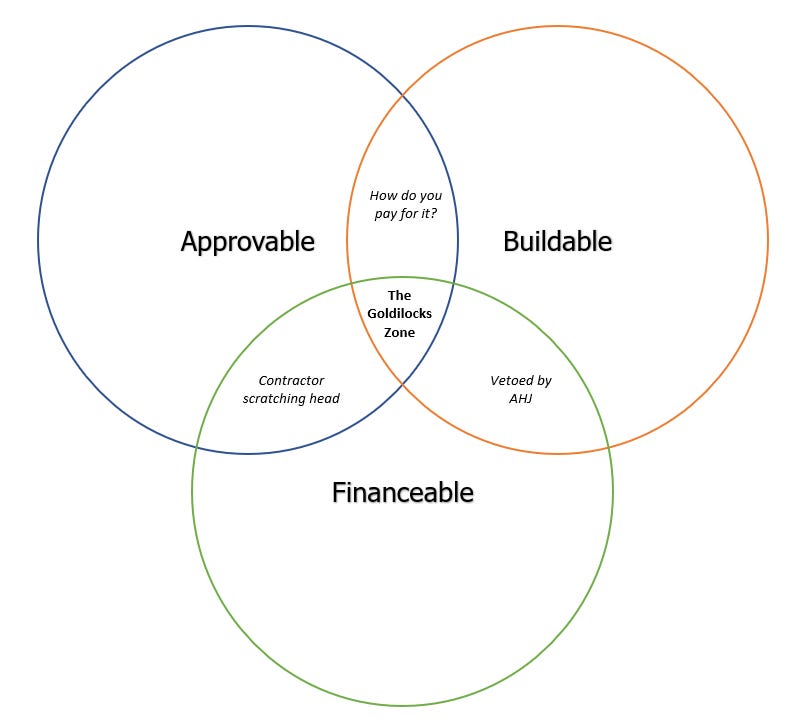

The Developer's Venn Diagram

Approve-able & Finance-able & Build-able

A huge number of projects are envisioned. Many less are actually drawn. A handful get the nod from the authority having jurisdiction. A blessed few actually start construction.

Why?

This question gets to the root of what makes the developers’ job challenging. For every piece of dirt there are very few outcomes that fit within the middle of the approvable, buildable and financeable Venn diagram. Oftentimes these interests are in direct contradiction, occasionally two of them line up, when all three in are in agreement you will see a huge line of developers beating down the doors of land sellers (think the single family for rent market today). This is turn drive up land prices, making financing an issue. In short, it’s tough but threading the needle is the developer’s job!

Let’s take them one at a time.

1) Approvable

Depending on the location, the size of the project, and what exactly you’re trying to do, there might be a governmental body that will vote on your project. Land use decisions are often a sizable part of what cities and counties do, so there is usually a prescribed process to follow. Almost assuredly it will be byzantine, have many steps, and include several detours and missteps along the way. Generally speaking, AHJs (authority having jurisdiction, which is a catchall term that could be a city, a county, or some governmental agency) want the best possible project. They want a project they can celebrate, that provides the most benefit to the community, that fills a gap or satisfies a need. They will ask for a lot - as they should. Particularly when a developer is asking for something outside of the box, AHJs have gotten wise: they control the approval process (either through timing or outright) and thus ask for a lot. Specific communities are very diverse in their desires — in the Bay Area much of the discussion is focused around Affordable Housing, Green/Open Space, and Community Benefits Fees (dollars paid directly to the city).

While some places have “by-right” approvals (the wild west in Houston as example), AHJs have understandably been very resistant to giving up control over land use decisions. In California, the State Legislature has tried to erode “local control” through State and Assembly bills - but it is a slow arduous process with many opponents.

You should expect to work deeply and authentically with you AHJ - more to come later on how to work effectively in this unique environment.

2) Financeable

Theoretically, this should be the most ‘rational’ of the three circles. Real estate investors (huge and tiny), banks, private equity, hard money lenders, etc. are all quantitative, profit motivated, and expect to make a reasonable return for the risk they are taking. A bit of a dirty little secret - this group often falls into the same herd mentality that affects us all. They read the same news. They are on the same webinars. And like all of us, they hate to look stupid. Funding trends gather momentum, and capital providers who take a truly contrarian view are few and far between.

How does that affect the typical development deal?

Most development firms have internal metrics they expect will get traction within the capital markets (another catchall term for folks who provide funding for projects). I.e. “We expect apartment projects that show a 5+% return on cost to be able to attract capital,” or “A 15+% IRR should greenlight private equity financing.” Once a developer has a project they think meets those metrics, they will send out detailed information (plans, reports, proforma, costs, etc.) to their preferred capital providers, or a broker who can connect to the wider market. Then they wait for feedback:

Doesn’t meet our return thresholds

Don’t believe your rent growth assumption

Job growth is declining in that geo - pass

We’ve never done a deal there, we need to study the market

Rarely is the answer an immediate yes. The road to yes starts with, “Interesting, let’s keep investigating.” Relationships and past performance are critical if outside the “strike zone” of a capital provider. Meanwhile, those organizations are constantly in flux trying to take advantage of numerous new opportunities - what they were looking for 2 years ago is certainly different than it is today. Their capital is limited, and their job is often to protect the firm’s downside.

The water here is deep and industry pros abound who’s only focus is capitalizing (funding) deals. The good news is, in today’s market in 2021, there is a lot of capital chasing relatively few good deals. If you have deal that makes sense, you should be able to find funding - but those deals are hard to find!

3) Buildable

Buildable covers a wide swathe of requirements that can hamstring potential projects. A couple of examples:

Hard Cost (construction) pricing in excess of the budget

Architecture that can’t be built as shown. Imagine showing a wall of windows where you need to put a bathroom.

Environmental contamination disallows the use you were planning

Too close to the airport to go as high as you planned

Sea level rise threatens ground floor use

Generally, a developer will engage a contractor early in the process to give them cost feedback, constructability comments, and guide them a project that is buildable to a set budget. Here in the Bay Area, contractors are busy! Getting their attention (and their subcontractors attention) can be a challenge for a speculative project that is a year or two from starting construction. As you get closer to physically starting the project, your star will rise. An approved project with solid financing behind it with a hopeful start date in the near term may allow you get several contractors to bid upon the project. But, if that number comes in over-budget, you’re back to the drawing board making the dreaded “value engineering” (VE) decisions.

While contractors are sometimes portrayed as the dream killers of the project (particularly by architects enamored with their creation) - their realistic input is critical to making sure your financial feet are firmly on the ground. As above, long term relationships with past successes behind you enable more attention early in the process.

In Closing

The so-called goldilocks zone is rarely hit with the first idea. You’ll start with a vision, slowly refined by the design team to what fits on the site under the rules of jurisdiction. The AHJ will give you constant feedback and push for more of what they want. Your capital partners will refine their return requirements as your contractor updates the budget.

You tweak, you update, you rethink. You persevere.

Hopefully, you ultimately arrive at a project that is approved by the AHJ, have a contractor with a signed Guaranteed Maximum Price (GMP), and a capital partner with an agreed-to term sheet. Then, it’s off to the races before someone changes their mind!